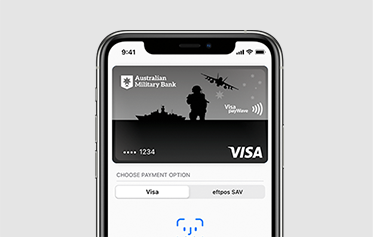

The easy, secure and private way to pay.

Using Apple Pay is simple and it works with the devices you use every day. Your card information is secure because it isn't stored on your device or shared when you pay. Paying in stores, apps and on the web has never been easier, safer, or more private.*

Paying in stores

Apple Pay is the easiest way to pay in stores with your iPhone and Apple Watch. You can quickly check out using the devices you carry every day.

Paying in apps and on the web

Use Apple Pay to make purchases in all kinds of apps on your iPhone and iPad. Paying is as simple as selecting Apple Pay at checkout and completing the payment using Face ID or Touch ID. Apple Pay is also the easier, safer way to pay online in Safari on your iPhone, iPad, and Mac, as you no longer have to create an account or fill out lengthy forms. Simply pay and go. You can also pay on your MacBook using Touch ID.*

Set-up is simple

Adding your card to Apple Pay is easy.

Here’s how to get started:

iPhone |

|

|

|

Apple Watch |

|

|

|

iPad |

|

|

|

Australian Military Bank app |

|

|

|

When you add your Australian Military Bank card to Apple Pay, the card will be defaulted to the Visa network for payments with Apple Pay. To change the payment network on:

iPhone |

|

|

|

|

Apple Watch |

|

|

|

|

Lost or Stolen cards

Call us straight away so that we can cancel your card. When you request a new card we’ll update your lost or stolen card details automatically in Apple Pay. And while you wait for your new card to arrive, you can keep making all your everyday purchases using Apple Pay on iPhone, Apple Watch, iPad and Mac.

What should I do if my card is lost or stolen

You should contact us straight away on 1300 13 23 28 so the lost or stolen card can be cancelled and no further purchases made. When the replacement card is issued we will automatically update Apple Pay with your new card details. You can continue to make purchases using Apple Pay before your new card arrives. You may be limited to transactions under $100 until your new PIN arrives, you can also update your PIN via Internet or Mobile Banking.

FAQs

Which Apple devices can I use?

Apple Pay is available on iPhone, iPad, Apple Watch, Mac with Touch ID, Mac with an Apple Pay enabled iPhone or Apple Watch and the latest OS.

For a list of compatible Apple Pay devices, see https://support.apple.com/en-au/HT208531

Does Apple store the card details?

No, your card details are not stored on the device or in the Cloud. When a card is added to Apple Pay, a Device Account Number replaces the need for the card number.

Does it cost me anything to use Apple Pay?

No, it does not cost you anything extra to use Apple Pay.

The usual credit or debit charges apply to purchases and some retailers may apply a credit or debit card surcharge to purchases made using any payment method, including Apple Pay, contactless or chip and PIN transactions.

You require an active data plan or Wi-fi connection to add your card to Apple Pay. Based upon your mobile plan and network, additional message and/or data charges may apply.

How do I activate my card with Apple Pay?

For security purposes, when a new card is added to Apple Pay we’ll ask you to complete a verification check before it can be used with Apple Pay. We’ll either:

- Send a one-time password to the mobile phone number you have registered with us

- Send a one-time password to the email address you have registered with us

- Ask you to call us on 1300 13 23 28 and answer some security questions

- Direct you to our mobile banking application to activate your card with Apple Pay

Can a single card be added to multiple Apple Pay wallets?

Yes, a card can be added to Apple Pay on multiple devices, however the card will need to be added to each device separately.

Can I use Apple Pay on public transport?

Some public transport networks offer ticketing options using Apple Pay. Please ensure you check your relevant transport provider in your state in regards to fares and device usage. For our NSW members please see this link and be aware that rules apply to how you use Apple Pay to travel.

Disclaimer

*Apple Pay works with iPhone 6 and later in stores, apps and websites in Safari; with Apple Watch in stores and apps; with iPad Pro, iPad Air 2 and iPad mini 3 and later in apps and websites; and with Mac in Safari with an Apple Pay enabled iPhone 6 or later or Apple Watch. For a list of compatible Apple Pay devices, see https://support.apple.com/en-us/HT208531

Apple, the Apple logo, Apple Pay, Apple Watch, Face ID, iPad, iPhone, iTunes, Mac, Safari, and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries. iPad Pro is a trademark of Apple Inc.

For full terms and conditions please read our Terms and Conditions for Digital Wallets.